ABOUT DOCUMENT

| Version No. | Prepared by | Version Changes | Date |

| V1.0.0 | Deepthi Joseph & Shanty Justus, PIT Solutions Pvt Ltd | Prepared initial document version | 31.03.2020 |

| V1.0.1 | Soumia George, PIT Solutions Pvt Ltd | Added Amasty Recurring Payment module and limitations with the Recurring module | 09.04.2020 |

| V1.0.2 | Shanty Justus, PIT Solutions Pvt Ltd. | PSD2 Changes | 06.05.2020 |

| V1.0.3 | Erich Zeiler-Rausch Worldline Payment Services | Proofread and public release | 14.05.2020 |

| V1.0.4 | Deepthi Joseph & Shanty Justus, PIT Solutions Pvt Ltd Payment Services | iDEAL Preselection for bank account, Saferpay Fields for "Save card", Redirect URL in lightbox for checkout with Saferpay Fields and Transaction Interface | 06.10.2020 |

| V1.0.5 | Shanty Justus, Deepthi Joseph, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento version 2.4.1 and Amasty Subscriptions & Recurring Payments Version 1.6.3, Added Klarna payment method. | 23.12.2020 |

| V1.0.6 | Shanty Justus, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento version 2.4.2, Fixed the compatibility issues when Amasty Subscriptions & Recurring Payments extension is not installed, Fixed the error of sending incorrect LanguageCode to API | 23.04.2021 |

| V1.0.7 | Shanty Justus, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento version 2.3.7 and 2.4.2 p1 | 10.06.2021 |

| V1.0.8 | Shanty Justus Deepthi Joseph PIT Solutions Pvt Ltd Payment Services | Crypto Payments, New countries for Klarna Payments, New currencies for SOFORT, EPS Refund support, Removed Bonus card | 14.07.2021 |

| V1.0.9 | Shanty Justus, Deepthi Joseph, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento version 2.4.3, 2.3.7-p2 and 2.4.3-p1 and Amasty Subscriptions & Recurring Payments Version 1.6.8, API Spec version updates from 1.23 to 1.25 | 14.12.2021 |

| V1.1.0 | Shanty Justus ,PIT Solutions Pvt Ltd Payment Services | Fixed the shopping cart deletion issue when the order is cancelled or failed | 12.01.2022 |

| V1.1.1 | Shanty Justus, PIT Solutions Pvt Ltd Payment Services | Fixed the issue of sending ipv6 address to Saferpay | 10.02.2022 |

| V1.1.2 | Shanty Justus, PIT Solutions Pvt Ltd Payment Services | Handled the magento feature of asynchronous sending of order and invoice emails | 08.03.2022 |

| V1.1.3 | Shanty Justus, Deepthi Joseph, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento version 2.4.4 and Amasty Subscriptions & Recurring Payments Version 1.6.9 & 1.6.10, API Spec version updates from 1.25 to 1.28 | 06.09.2022 |

| V1.1.4 | Shanty Justus, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento version 2.4.4 p2, 2.4.5 &2.4.5 p1, API Spec version updates from 1.29 to 1. | 16.11.2022 |

| V1.1.6 | Shanty Justus, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento version 2.3.0 – 2.4.6 | 18.04.2023 |

| V1.1.8 | Shanty Justus, Soumia George, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento API Spec version updates from 1.31 to 1.34, Compatible with Amasty Subscriptions & Recurring Payments Version 1.6.10 and Added GraphQL support for Magento versions from 2.4.0 to 2.4.6 | 22.06.2023 |

| V1.1.9 | Shanty Justus, PIT Solutions Pvt Ltd Payment Services | Fixed the soap webservice API error & Recurring Payments error | 20.09.2023 |

| V1.2.0 | Shanty Justus, Soumia George, PIT Solutions Pvt Ltd Payment Services | Compatible with Magento API Spec version 1.35, Added GraphQL support for Magento versions from 2.3.3 to 2.4.6, Compatible with Amasty Subscriptions & Recurring Payments Version 1.6.10 – 1.6.12, Added new option “Auto capture” in the Liability shift behaviour settings, Added fix for the warning in cron execution when table prefix is present in the database | 30.11.2023 |

| V1.2.1 | Shanty Justus, Soumia George, PIT Solutions Pvt Ltd Payment Services | Added updates of Magento API Spec version from 1.36 to 1.38,Compatible with Magento Version 2.3.1 to 2.4.6 p3, Added GraphQL support for Magento versions from 2.3.3 to 2.4.6 p3, Compatible with Amasty Subscriptions & Recurring Payments Version 1.6.13 | 25.01.2024 |

| V1.2.2 |

Shanty Justus, Soumia George, PIT Solutions Pvt Ltd Payment Services |

Compatible with Magento Version 2.3.0 to 2.4.6 p4. Compatible with Amasty Subscriptions & Recurring Payments Version 2.0.0, Saferpay feature enhancements, Added fix to prevent calling Transaction Authorize API from cron which cancels the abandoned orders., Added fix to display card holder name in saferpay payment page when 'Display cardholder name on saferpay’ set to ‘Yes’ in the Magento backend payment method settings | 16.04.2024 |

| V1.2.3 |

Shanty Justus , Vishnu S, PIT Solutions Pvt Ltd Payment Services |

Compatible with Magento Version 2.3.0 to 2.4.7 p1, Compatible with Hyva theme 1.3 and Hyva checkout 1.1. Added updates of Saferpay JSON API Spec version from 1.39 to 1.40, Added GraphQL support for Magento versions from 2.3.3 to 2.4.6, Added “Save Card” for CreditCard, Added option to capture the invoice that got interrupted due to Saferpay error. | 25.07.2024 |

| V1.2.4 |

Shanty Justus, Vishnu S, PIT Solutions Pvt Ltd Payment Services |

Compatible with Magento Version 2.4.0 to 2.4.7 p3, Compatible with Hyva theme 1.3 and Hyva checkout 1.1. Added updates of Saferpay JSON API Spec version from 1.41 to 1.43, Added GraphQL support for Magento versions from 2.4.0 to 2.4.7 p3, Compatible with Amasty Subscriptions & Recurring Payments Version 2.0.0, 2.0.1, 2.0.2 | 04.12.2024 |

| V1.2.5 |

Shanty Justus, PIT Solutions Pvt Ltd Payment Services |

Added a new option in Googlepay and Applepay wallet payment settings in Admin panel to select either "wallet only" or "wallet along with card entry form" in the payment page | 28.01.2025 |

ABOUT SAFERPAY

Saferpay is the easy, flexible, secure and the comprehensive e-payment solution from Worldline (former SIX Payment Services) for easier and more secure payment in your online shop.

Worldline [Euronext: WLN] is the European leader in the payments and transactional services industry and #4 player worldwide. With its global reach and its commitment to innovation, Worldline is the technology partner of choice for merchants, banks and third-party acquirers as well as public transport operators, government agencies and industrial companies in all sectors. Powered by over 20,000 employees in more than 50 countries, Worldline provides its clients with sustainable, trusted and secure solutions across the payment value chain, fostering their business growth wherever they are.

ABOUT MAGENTO MODULE

This module is implemented to integrate Saferpay Payment methods in Magento. It supports the following payment methods of Saferpay to work with default Magento 2 checkout.

- VISA

- MASTERCARD

- MAESTRO

- AMERICAN EXPRESS

- BANCONTACT

- DINERS/DISCOVER

- JCB

- SEPA ELV

- MYONE

- MASTERPASS

- UNIONPAY

- PAYPAL

- TWINT

- PAYDIREKT

- IDEAL

- EPRZELEWY

- APPLE PAY

- ALIPAY

- CREDITCARD (SAFERPAY FIELDS)

- SOFORT

- GIROPAY

- EPS

- BILLPAY PURCHASE ON RECEIPT

- BILLPAY DIRECT DEBIT

- KLARNA PAYMENTS

- WL CRYPTO PAYMENTS

- GOOGLEPAY

- POSTFINANCE PAY

- ACCOUNT-TO-ACCOUNT

- CREDITCARD / DEBITCARD

- WECHATPAY

-

CLICK TO PAY

-

BLIK

This module supports all the features of online payment methods like invoice capturing, refunding & cancellation. All these payment operations done in the Magento backend will be synced to Saferpay account also.

REQUIRMENTS

To install and configure Saferpay module in Magento, the following is required:

- Magento installation with version between 2.4.0 to 2.4.7 p3

- The license for the Saferpay module.

- A valid Saferpay account with at least one active Saferpay terminal through which payments can be carried out

- API credentials like Terminal ID, Customer ID, JSON Username and JSON Password for the Saferpay Live- and/or Test environment

- Valid acceptance agreement for payment methods.

INSTALLATION

To install Saferpay module follow the steps below.

- Download Saferpay module extension and unzip it.

- Access your web server directories and upload the content of the folder into the root directory

- Run the following commands to complete the installation.

- Enable the module

- php bin/magento module:enable --clear-static-content Saferpay_PaymentService

- php bin/magento module:enable --clear-static-content Saferpay_RecurringPayments. (Disable this module if the shop does not use Amasty recurring module)

- php bin/magento module:enable --clear-static-content Saferpay_HyvaCheckout. (Disable this module if the shop does not use Hyva theme and Hyva Checkout)

- Update of the database

- php bin/magento setup:upgrade

- Generate and pre-compile classes

- php bin/magento setup:di:compile

- Deploy static files

- php bin/magento setup:static-content:deploy [locale]. [locale] should be replaced by ISO-639 language codes for which to output static view files.

- Enable the module

CONFIGURATION

Saferpay module configuration includes two section

- General configuration

- Payment method specific configuration

GENERAL CONFIGURATION

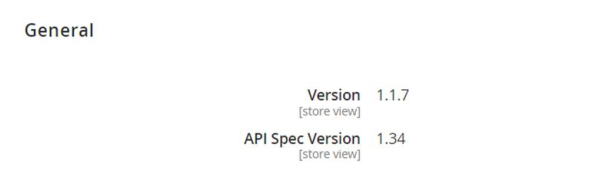

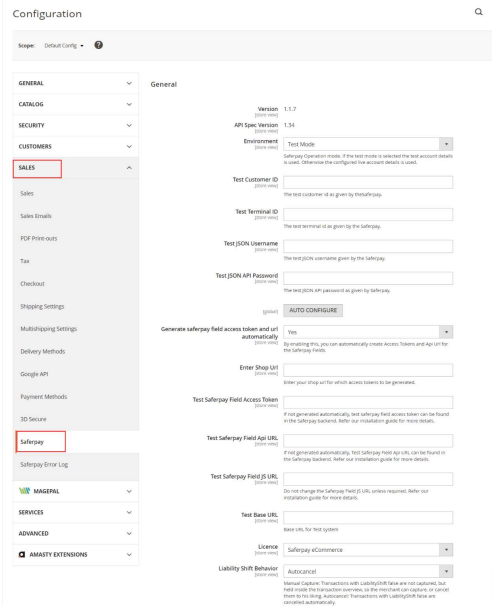

Configure general module settings from Stores > Configuration > Sales > Saferpay Tab

General Plugin information can be viewed from here

- Version : Current Plugin Version

- API Spec Version : Current API Spec version. This gives information about technical features, modifications and enhancements that are integrated

The following configuration options are available in General section

- Environment: It defines the Saferpay Operation mode. The dropdown will allow merchant to quickly switch between live and test environment. By default, test mode is selected

- Test Customer ID/Live Customer ID

- Test Terminal ID

- Test JSON Username

- Test JSON API Password

- Generate Saferpay Fields access token and url automatically

Configuration fields from 1 to 5 must be filled in if you want to create access token automatically.

- Enter Shop Url

- Test Saferpay Fields Api Key

- Test Saferpay Fields Api URL

6, 7: if not generated automatically , the details can be obtained from Saferpay backend -> Settings -> Saferpay Field Access Tokens

- Test Saferpay Fields JS URL

This is the Saferpay Fields Javascript library url. Do not edit this if are unaware of the functionality

- Test Base URL

These fields already have default values of api base url. Do not edit this if are unaware of the functionality

Fields from 2 to 9 may vary based on the operation mode opted. Data is available from Saferpay Backoffice. To get access information for live environment you have to request an offer here. To get access information to test account please follow this link.

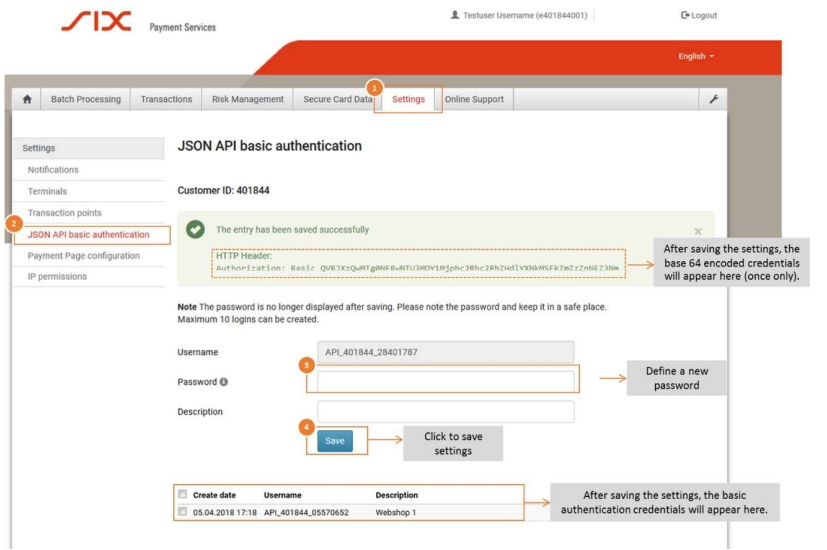

To get JSON API username and password you have to login to Saferpay management interface and go to Settings -> JSON API basic authentication.

AUTO CONFIGURE

Payment methods can be configured automatically by using the "Auto Configure" button. Before you auto configure make sure that all basic configurations are filled out. The available payment methods in your Saferpay customer account will be checked when you click auto configure button, and those payment methods will then be enabled. Afterward, you can go to Sales > Payment Methods and make the necessary changes if you want to disable any payments or modify any configurations.

- Licence: Choose the Saferpay licence you own.

Saferpay has two licenses:

-

- Saferpay eCommerce

- Saferpay Business

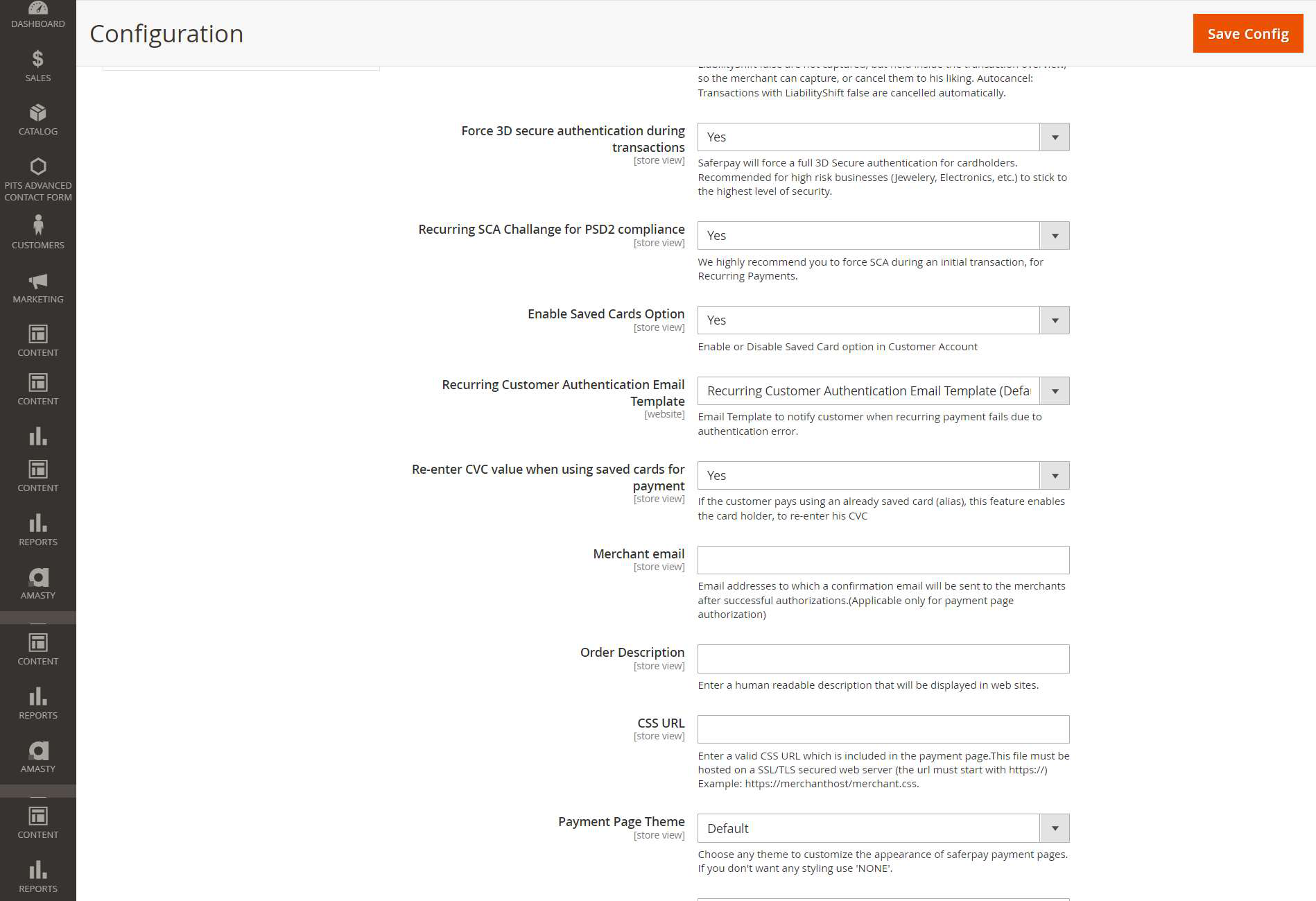

- Liability Shift Behaviour

This field determines how to handle the transactions when Liability Check for card Fails. When using this functionality, the liability shifts to the authorizing bank and the store owner receives no claim for any chargeback if a fraudulent card is used on their website.

-

- Manual Capture: Transactions with false LiabilityShift are not captured, but it gets authorized. Later the merchant can capture, or cancel the order as he wish.

- Autocancel: Transactions with false LiabilityShift are cancelled automatically.

- Auto Capture: Transactions with LiabilityShift false are captured automatically, if the capture type of payment method is also set to auto capture. If payment method capture type is “Manual Capture”, the transaction will not be captured, instead the transaction is made authorized so that merchant can manually capture or cancel his order.

- Force 3D secure authentication during transactions

If you enable this option, Saferpay will force a full 3D Secure authentication for cardholders. It is recommended for high risk businesses (Jewellery, Electronics, etc.) to stick to the highest level of security.

- Recurring SCA challenge for PSD2 Compliance

Saferpay module is compatible with Amasty recurring module. This field is applicable only for orders with subscription products. It ensures the PSD2 compliance of the recurring payments done through Saferpay while Amasty extension is enabled.

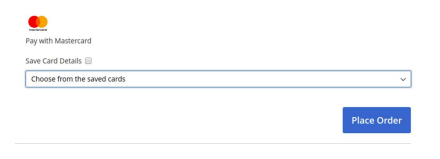

- Enable Saved Cards Option

Customers can save their card details in customer account if this configuration is enabled. They will get access to tab “Saved cards”.

- Recurring Customer Authentication Email Template

There is a possibility for payment failure due to soft decline of cards during recurring transaction. During such scenarios this template is used to send email to customers notifying them about transaction error.

- Re-enter CVC value when using saved cards for payment

This option is used to provide additional security when the customer uses saved cards for the checkout. While this option is enabled, it asks the cardholder to re-enter his CVC if he uses saved card for checkout, and hence the transaction would be fully secure and PCI compliant

- Merchant email

Email addresses (Merchant email) to which a confirmation email need to be send after successful payment authorizations. (Applicable only for payment page authorization)

- Order Description

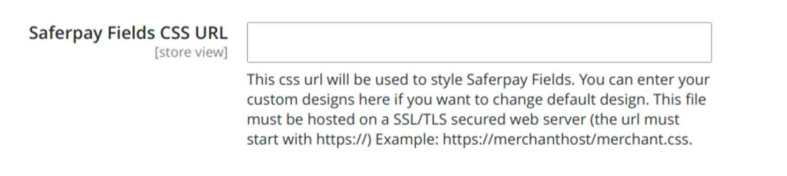

- CSS URL

Enter a valid CSS URL which is included in the payment page. This file must be hosted on an SSL/TLS secured web server (the url must start with https://) Example:https://merchanthost/merchant.css.

Refer https://saferpay.github.io/sndbx/CssiFrame.html for more details

- Payment Page Theme

Choose the theme to customize the appearance of Saferpay payment pages. Per default a lightweight responsive styling will be applied.

- Saferpay Configuration

Saferpay Payment Page configurations is used to configure design and other details inside hosted pages. The configuration can be created from Saferpay Backoffice ('Settings > PaymentPage Configuration'). The configuration marked as 'default' will be used as the standard setting if none

- Enable Log

All the error details regarding a transaction will be logged to custom log if this option is enabled. Refer Log section for more information

- Email Template on cancellation of order

There may be possibilities for cancelling authorized transaction due to failed 3Ds check. During such scenarios this template is used to send email to customers notifying them about payment cancellation.

- GraphQL Support

GraphQL is indispensable for creating Magento PWAs. Saferpay Extension provides GraphQL support so that PWA developers and Mobile app developers can make use of it. This will work for Magento versions from 2.3.3 to 2.4.6 p3

PAYMENT METHOD SPECIFICS

Account-to-Account Payments - Refer https://docs.saferpay.com/home/integration-guide/payment-methods/account-to-account-payments

Alipay - https://docs.saferpay.com/home/integration-guide/payment-methods/alipay+

Apple Pay - https://docs.saferpay.com/home/integration-guide/payment-methods/applepay

American Express - https://docs.saferpay.com/home/integration-guide/payment-methods/american-express

Bancontact - https://docs.saferpay.com/home/integration-guide/payment-methods/bancontact

Diners - https://docs.saferpay.com/home/integration-guide/payment-methods/diners-and-discover

ePrzelewy - https://docs.saferpay.com/home/integration-guide/payment-methods/eprzelewy

EPS - https://docs.saferpay.com/home/integration-guide/payment-methods/eps

Giropay - https://docs.saferpay.com/home/integration-guide/payment-methods/giropay

Google Pay - https://docs.saferpay.com/home/integration-guide/payment-methods/google-pay

iDEAL - https://docs.saferpay.com/home/integration-guide/payment-methods/ideal

JCB - https://docs.saferpay.com/home/integration-guide/payment-methods/jcb

Klarna - https://docs.saferpay.com/home/integration-guide/payment-methods/klarna-payments

Maestro - https://docs.saferpay.com/home/integration-guide/payment-methods/maestro

Mastercard - https://docs.saferpay.com/home/integration-guide/payment-methods/mastercard

Paydirekt - https://docs.saferpay.com/home/integration-guide/payment-methods/paydirekt

PayPal - https://docs.saferpay.com/home/integration-guide/payment-methods/paypal

PostFinance Pay - https://docs.saferpay.com/home/integration-guide/payment-methods/swiss-postcard-and-postfinance

SEPA ELV - https://docs.saferpay.com/home/integration-guide/payment-methods/sepa-direct-debit

Sofort - https://docs.saferpay.com/home/integration-guide/payment-methods/sofort-by-klarna

TWINT - https://docs.saferpay.com/home/integration-guide/payment-methods/twint

UnionPay - https://docs.saferpay.com/home/integration-guide/payment-methods/china-unionpay

Visa - https://docs.saferpay.com/home/integration-guide/payment-methods/visa-and-vpay

WeChat Pay - https://docs.saferpay.com/home/integration-guide/payment-methods/wechat-pay

WL Crypto Payments - https://docs.saferpay.com/home/integration-guide/payment-methods/crypto-payments

Click to Pay - https://docs.saferpay.com/home/integration-guide/payment-methods/click-to-pay

Blik - https://docs.saferpay.com/home/integration-guide/payment-methods/blik

PAYMENT METHOD SPECIFIC CONFIGURATION

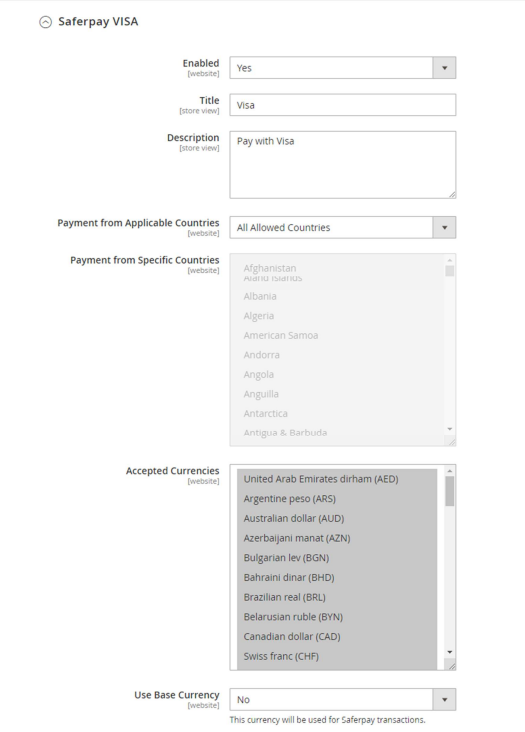

Individual payment methods which come under Saferpay can be configured from System > Configuration > Sales > Payment Methods section. Not all payment will be in your contract so be careful while enabling payment methods.

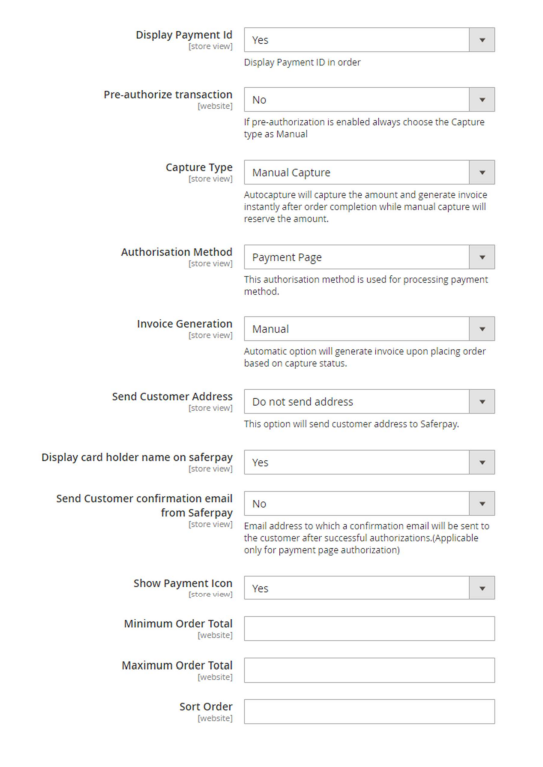

Saferpay specific configuration are explained in detail.

- Enabled

Enable or Disable payment methods - Title

The title displayed to the customer on the store front during checkout. - Description

Description for the payment - Payment from Applicable Countries

By default, it is set to All Allowed Countries. - Payment from Specific Countries

If you wish to accept payment from specific countries, you can select the countries in Payment from Specific Countries. - Accepted Currencies

Choose the currencies that can be processed with this payment. If no currency is selected payment will not be available even though it is enabled individually.

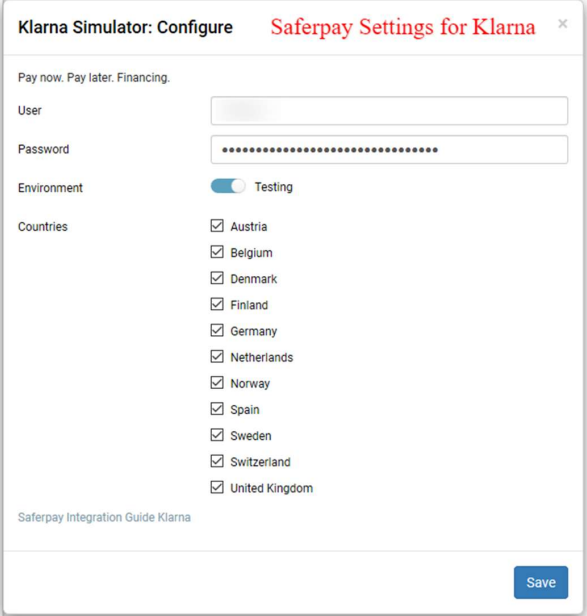

Some payments like Klarna may have country and currency restrictions. So be careful in choosing countries and ensure that these countries are activated in your Klarna payment settings in saferpay account also.

For Klarna to work properly, currency code should be in-line with country code.

- Use Base Currency

Defines whether Magento base currency should be used for processing the transaction. If this is enabled, only the payment methods that supports base currency will be listed during checkout.

- Authorisation Method

Authorisation Method defines how the payment method is displayed and processed. Some payments support multiple authorisation methods while others support single.- Payment page – During the order processing the user is redirected from the Magento shop to the Saferpay payment gateway to process the payment. On successful completion of the payment the user will be redirected back to the Magento shop. The Saferpay Payment Page Interface is intended for a simplified and universal integration of the payment process by using the PaymentPage payment form. The Saferpay Payment Page can be used both with a Saferpay eCommerce license and with a Saferpay business license. All Saferpay supported payment methods can be processes with the Payment Page Interface.

- Transaction Interface - During the order processing the user is served with Saferpay payment forms opened in a lightbox within the Magento shop. The Transaction Interface is an extension to Payment Page Interface. It offers the Hosted Entry Form (HEF) to process card payments seamlessly. This interface can also be used in combination with Secure Card Data to store/tokenize payment data during the payment process. The Transaction Interface is only for holders of a business licence on the live system

- Saferpay Fields - will be hosted on Saferpay-side and will offer you a level of fflexibility and the possibilities, similar to using your own form. The data is captured by a fully PCI-certified system.

- Capture Type

This indicated how payment provider should behave when order is created. There are two options:- Autocapture: It will automatically capture the amount in the order.

- Manual capture: The payment will be authorized, but merchant will have to capture manually form shop Backend

- In Magento from version 2.4.7-p1 to 2.4.7-p3, manual capture and cancelation of invoices may not function as expected. This is Magento issue identified and the following patches address the solution:

- Patch for Invoice Cancelation: Addresses issues related to cancelling invoices.

- Patch for Manual Invoice Capture: Resolves manual invoice capture problems.

- Invoice Generation

This field determines when to generate invoice for the payments made through Saferpay if the capture type is set to Manual. For automatic Captures invoice will be generated instantly after payment in paid state.

-

- Manual: Invoice should be generated manually by merchant from Magento Backend.

- Automatic: Invoice will be generated automatically upon payment authorize in pending state.

- Send Invoice Email

If “send invoice” is enabled, invoice email is sent automatically after invoice capture.

- Pre-Authorize Transaction

When set to true the transaction is processed as pre-authorization otherwise as final authorization. If pre-authorisation is selected, the capture of the payment is prevented even though the capture type is “Autocapture “.

- Show Payment Icon

When enabled, the payment brand icon will be shown in checkout page and order email.

- Display Payment ID

This field determines whether transaction Id of the payment should be displayed in order confirmation page and order email.

- Send Customer Address

This option will send customer address to Saferpay.

- Display card holder name on Saferpay

This parameter let you customize the holder name field on the card entry form. Per default, a mandatory holder name field is shown.

- Register alias and use during checkout

By enabling this, the customer can register cards and use it for future payments. Card details will be stored in Saferpay. This option is available only for Transaction Interface Authorisation method.

- Send Customer confirmation email from Saferpay

Confirmation email will be sent to the customer after successful authorizations from Saferpay (Applicable only for payment page authorization)

- Minimum Order Total

Using this field merchant can set a minimum order limit. If the grand total of the order is less than the Minimum Order Total value, the payment cannot be processed through the payment method.

- Maximum Order Total

You can specify the maximum amount for the transaction that can be processed through this payment method.

- Sort Order

This option is for sorting the payment methods to display in the checkout page.

Once you have configured Saferpay payment method, review all the settings carefully. If everything is fine, click Save Config button at the top right corner.

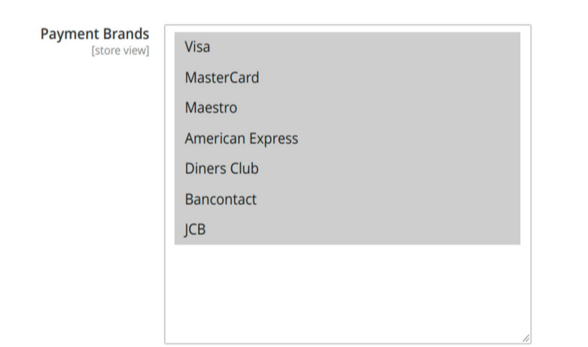

- Payment Brands

This configuration is available only for Credit Card and Apple Pay payments. It enables the merchant to choose the payment brands which will be accepted by these payments.By default, all brands are selected.

The selected brands will be accepted only if it supports the currency opted for Saferpay transactions.

- Saferpay Fields CSS URL

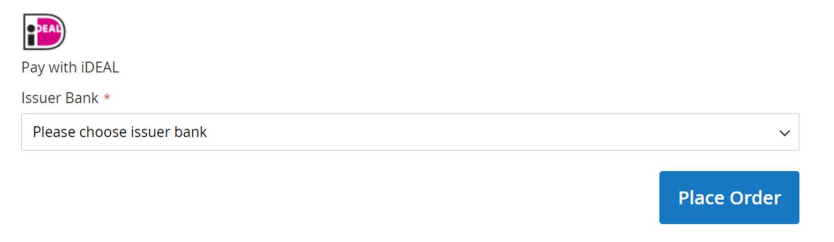

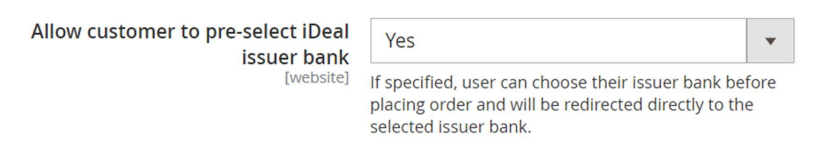

- Pre-Select issuer bank account

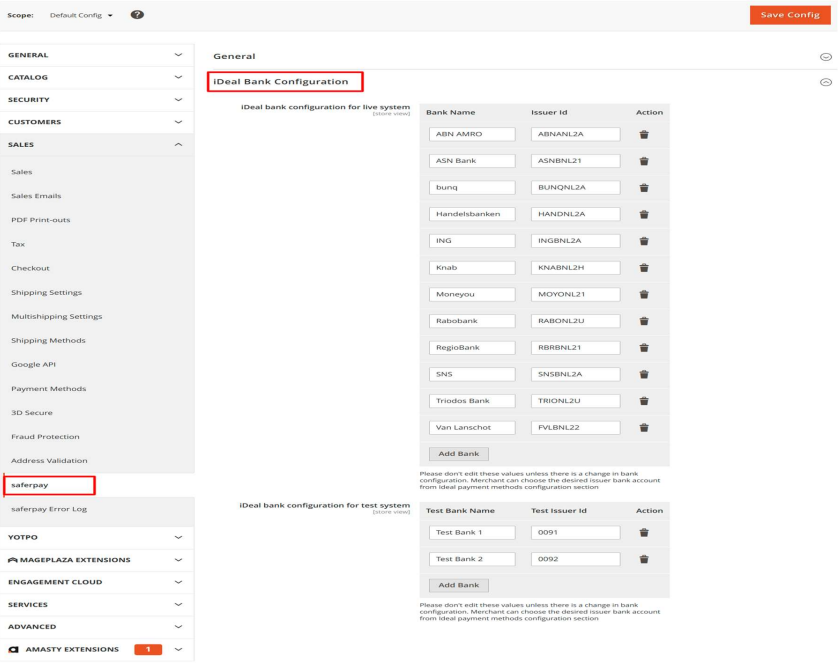

Attention: These Values are issued by iDeal, please check https://saferpay.github.io/sndbx/ideal.html. We have added option to add more bank when Saferpay support more banks in future.

We have provided an interface to edit/add the bank name and issuer Id if needed. You can configure it from the section Admin Panel > Stores > Configuration > Sales > Saferpay >iDeal Bank Configuration section.

Once you have configured Saferpay payment method, review all the settings carefully. If everything is fine, click Save Config button at the top right corner.

This preselect feature can be enable/disable from ideal backend configuration.

SAFERPAY FEATURES

DESIGN CUSTOMIZATION

If you want to customize the default design of Saferpay interface, Saferpay provides the following options

- CSS-Styling

-

- Payment page

- Transaction Interface

- Alias Insert

Refer https://saferpay.github.io/sndbx/CssiFrame.html#css-usecss for detailed information

- Theme

- Payment Page Configuration

If a custom CSS is provided, any design related settings set in the payment page config (PPConfig) will be ignored and the default design will be used.

ORDER MANAGEMENT

CAPTURE PAYMENT

If in the payment configuration “Capture type” is set to “Automatic”, merchant don’t need to do anything from Magento backend. Payments will be captured automatically by the system and no adjustments is possible for created invoice.

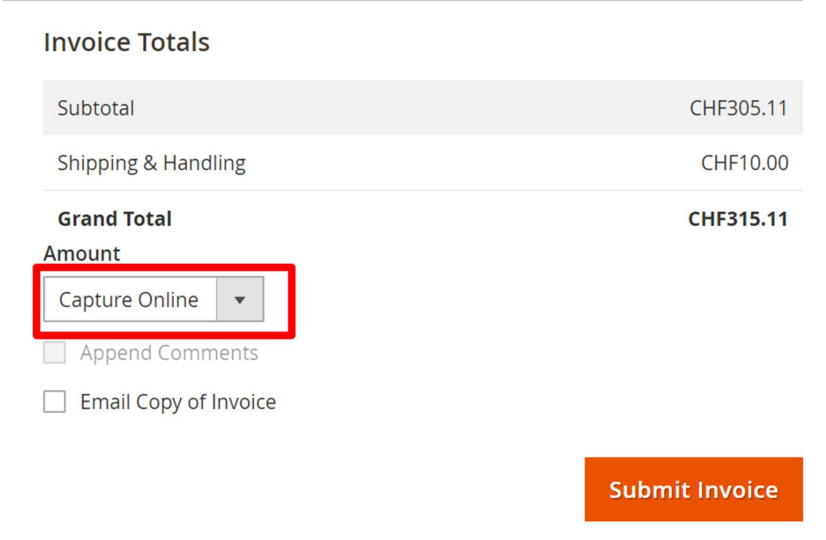

When the “Capture type” is set to “Manual”, merchant will have to capture payments manually through backend.

In order to create invoice, follow these steps

- Open the order you want to create invoice

- Click on the invoice option in header of the sales order

- Ensure that Capture Online is selected at the bottom of the Invoice

- Click Submit Invoice. If successful, an invoice will be created.

If the Capture type is set to Manual and Invoice generation to Automatic, then invoice will be created in pending state. All you need to do is to capture that invoice.

MULTIPART CAPTURE

Saferpay offers the option to do Partial Captures on transactions made with only certain payment methods. Magento supports multiple invoices for an order and each invoice can be captured separately. Please note that magneto doesn’t support multiple capture of a single invoice.

Multipart capture can be used over following methods

- Visa

- Mastercard

- Maestro

- PayPal

- American Express

- Diners

- JCB

- Klarna

- PostFinance Pay

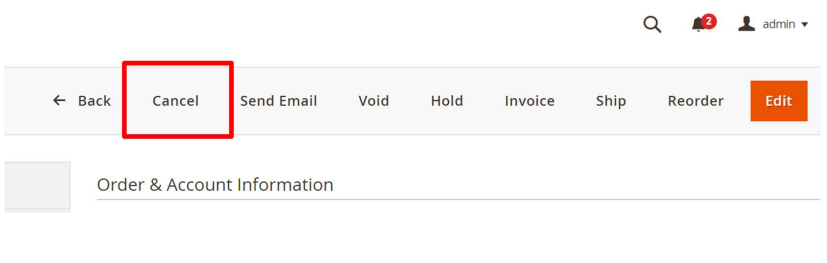

CANCEL PAYMENT

Only authorized, but not captured orders can be cancelled. Cancellation of an order prevents any future change from being made to it.

In order to cancel an order, click on the Cancel option in header of the sales order.

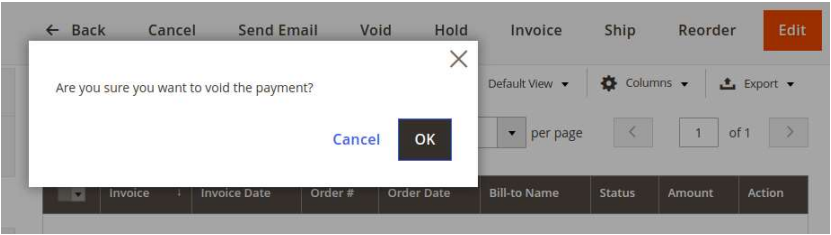

VOID PAYMENT

Authorized transaction can be cancelled by issuing a void in Magento. It will initiate money flow to the card holder by cancelling the transaction and prevent any further online transaction process for that order.

Captured transaction cannot be cancelled but can be refunded.

To Void payment, follow the below steps

- Go to Sales -> Orders and open the order you want to cancellation

- Click on the Void option in header of the sales order and confirm the Void

- Confirm the transaction and if successful it gets cancelled

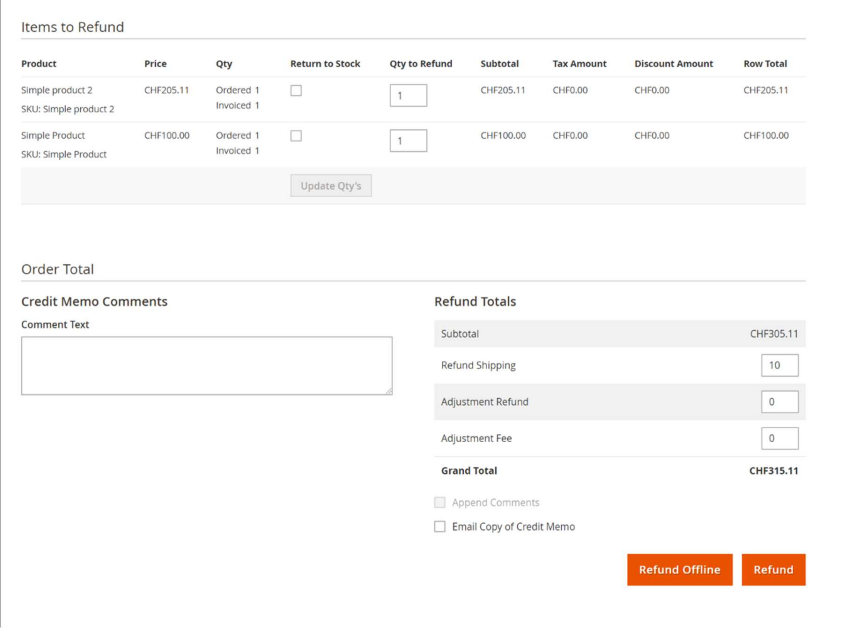

REFUND PAYMENT

Captured transactions can be refunded. Multiple refunds are possible on each invoice.

In order to refund payment, follow these steps

- Open the order and navigate to invoice section

- Select the invoice that you would like to refund and enter the invoice page by clicking View

- Click on Credit Memo option in the invoice page

- Adjust the item to refund by editing “Items to refunds” section

- Edit the Refund Totals Section to adjust the amount to refund. It is not possible to refund more than the total order amount.

- Click the Refund button at the bottom of the page.

- If successful, credit memo will be issued.

Note:Online credits can only be issued only from the invoice page in Magento, and not from the Order page.

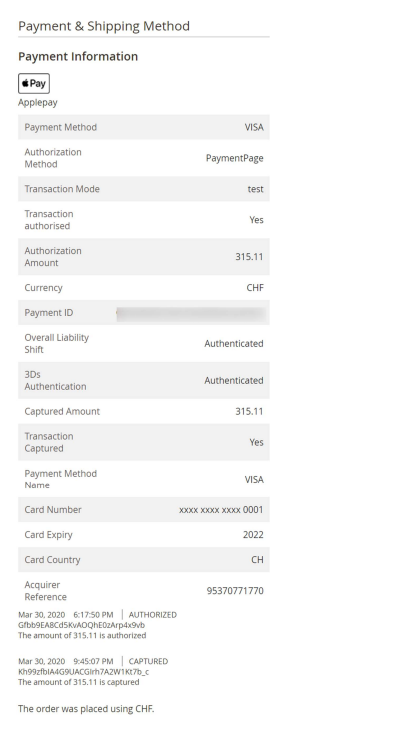

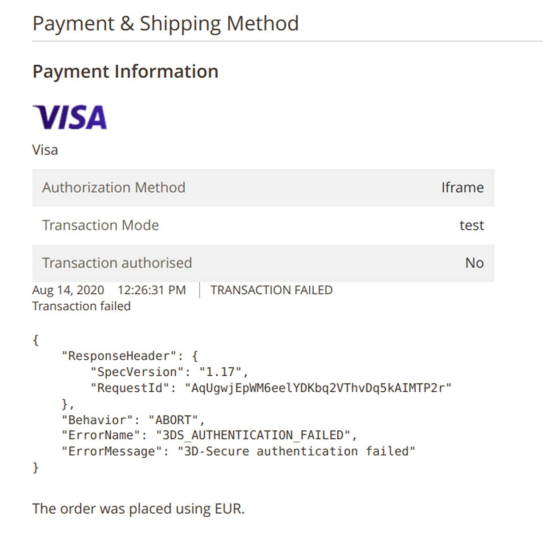

TRANSACTION OVERVIEW

Transaction overview section provides overview for an order at a glance. This section contains information about sales transaction, 3Ds check and card

In case of payment failure this section will provide the error details if available from API response

ALIAS MANAGER

Alias Manager allows your customer to save the credit card information and to reuse the saved information for future payments.

Saferpay Secure Card Data, or SCD for short, is a service for saving sensitive payment means information in the certified Saferpay data center. By using SCD, the payment data is separated from the merchant application and no longer comes into contact with it. The stored secure Card data can be referred from future payments initiated via Transaction” interface.

This feature is available for payment methods that supports secure card data. Sensitive payment data is stored only in certified Saferpay data centre. If the settings, “Register alias and use during checkout” is enabled, logged in customers can save and use their card for future transactions

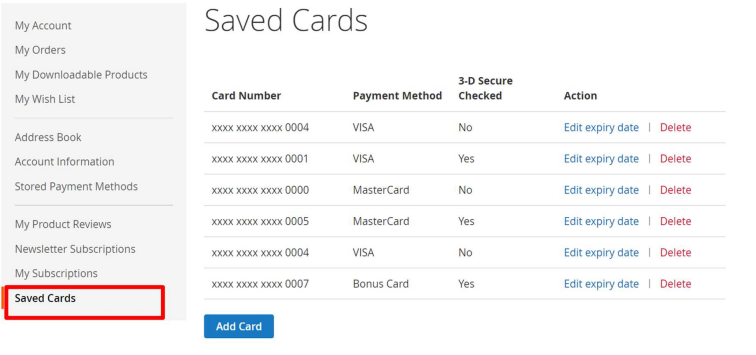

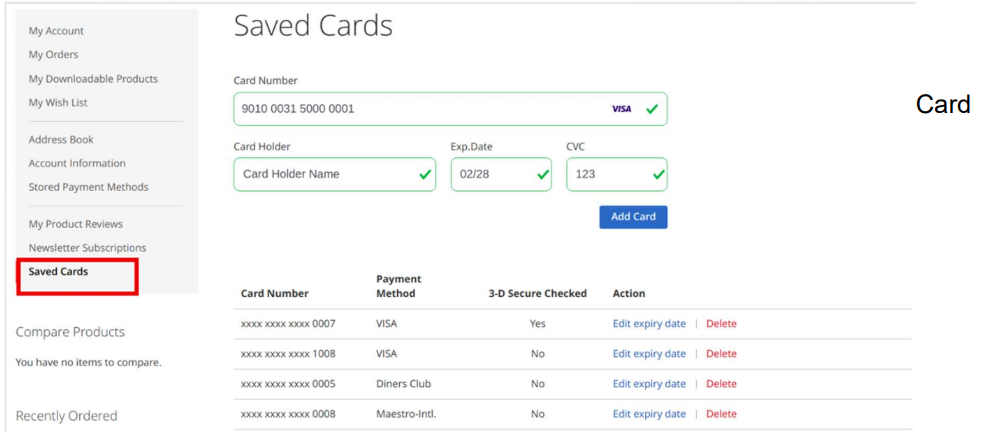

In addition to this, customer can manage the saved cards from his customer account

A new tab “Saved Cards” is added in the My Account page of Magento from which customers can add, update and delete cards from his account.

Customer can add below types of payment means to customer account

- Cards

- Twint – Saved card data is used only for recurring payments

- Postfinace - Saved card data is used only for recurring payments

Customer can enter and submit the card data in Saferpay hosted card entry form from the account page. If additional security check is required so as to perform actions like 3D Secure and/or DCC, a Saferpay page will be opened in Lightbox

Number – Displays the masked credit card number provided by Saferpay

Payment Method – Saved card type.

3-D Secure Checked – For some cards like Saferpay do 3D secure check while adding cards. Such cards can be identified from here. Please note that only 3D secured cards can be used for recurring payments if the general settings “Recurring SCA challenge for PSD2 Compliance” is enabled.

Customers have the option to update the expiry date of the card that is already saved.

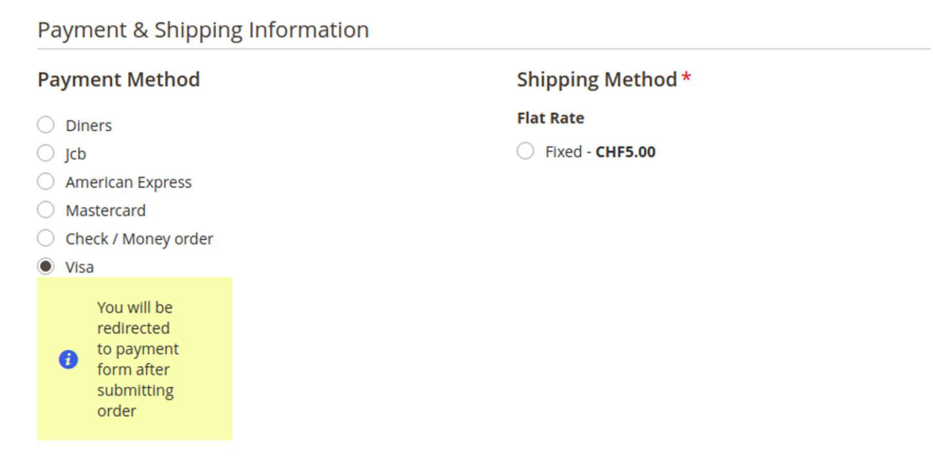

BACKEND ORDERS

Saferpay payment methods can be used for creating orders from Magento backend. The payments can be processed only through Transaction Interface. So please be careful about the authorization method you opted for corresponding payments.

Follow below steps to create order using backend

- Go to Admin Panel > Sales > Orders and press the Create New Order button.

- Choose the customer you want to create the order for.

- Once you've selected a customer you need to choose which store view you want the order to be created on.

- Add products to order

- Enter Customer Address Information

- Choose the payment and shipping methods

You will be redirected to payment gateway after submitting order

- After reviewing the order click on “Submit Order” button.

- The browser is redirected to the payment gateway. The merchant proceeds to payment by filling in the card details transmitted by the buyer and completes the transaction

- After successful payment the browser is redirected to the order detail page.

CRON FOR CLEARING ABANDONDED ORDERS

When the buyer has not completed the payment and the payment session has expired the order will be in “pending payment” state. A cron is automatically setup for clearing those orders.

As for all the other extensions, make sure you have configured and activated the job scheduler (crontab) as explained in the Magento documentation: https://experienceleague.adobe.com/en/docs/commerce-operations/configuration-guide/cli/configure-cron-jobs

ERROR LOGS

Error Log section provides information about transactions performed by Saferpay that could not be completed successfully.

Error details provided by payment gateway will be logged and displayed under System > Configuration > Sales > Saferpay Error Log section.

RECURRING PAYMENT MODULE

COMPATIBILITY WITH AMASTY RECURRING PAYMENT EXTENSION

This extension offers subscriptions alongside regular products to trigger long-term repeat sales. It allows customers to simultaneously purchase both regular products and subscriptions.

Please refer https://amasty.com/docs/doku.php?id=magento_2:subscriptionsrecurring-payments for more information about the extension.

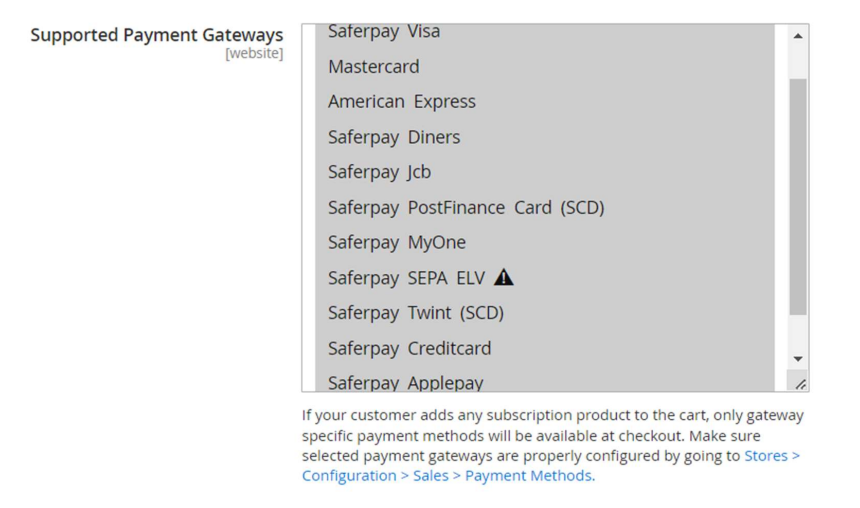

We have implemented Saferpay Magento module to be compatible with the Amasty Recurring payment extension version 2.0.0 After installing the Saferpay and Amasty recurring payment module, all of the Saferpay payment methods will get listed in the Amasty Recurring supported payment gateway list. Only the selected payment methods will be listed in the checkout page for subscription orders.

The following Saferpay payment methods are supported for subscription orders.

- VISA

- MASTERCARD

- AMERICAN EXPRESS

- DINERS

- JCB

- BONUS CARD

- MYONE

- CREDIT CARD (SAFERPAY FIELDS)

- Apple Pay

- Google Pay

- Creditcard / Debitcard

- Postfinance Pay – Payment possible only if saved card data available

- Twint – Payment possible only if saved card data available

The child subscription orders are created through amasty cronjob. The cronjob is executed every minute and new subscription orders are placed when the scheduled time arrives. If the subscription payment fails, then the subscription gets cancelled. In case of payment failure due to Soft Decline, a mail will be send to customer notifying about the authentication error.

The payment details are saved in the Saferpay account and not managed inside Magento, thus Saferpay module provides complete security of the sensitive payment details of the customers.

LIMITATIONS IDENTIFIED WITH THE AMASTY EXTENSION

Limitation 1: Cannot place the order when the order total is zero

Steps to Reproduce:

- Access shop backend

- Navigate to Stores > configuration > sales > amasty extension

- Enable free shipping for subscription products, Free trial is enabled and charge initial fee is NO

- Ensure that payment method “ZERO SUBTOTAL CHECKOUT” is enabled

- Try to create an order with a subscription product

- Observe that user cannot place the order when the order total is zero

Limitation 2: On creating an order with Grouped subscription product, the order is created as normal order instead of the subscription

Steps to Reproduce:

- Access the shop as a customer.

- Navigate to the grouped product, ensure subscription is enabled for the same.

- Add to cart & sproceed the order.

- Complete order creation

- Check the customer account page.

- The order is not listed @ "My subscription" in the customer account page

Limitation 3: Initial subscription fee for subscription orders with a configurable product or bundle products is wrong

Steps to Reproduce:

- Enable Initial subscription fee.

- Create a subscription order with a configurable product or bundle products

- Observe the initial fee subscription in the total summary of the cart page

Limitation 4: Initial subscription fee is displayed in all subscription mails even though this is not valid for the further subscription orders

Steps to Reproduce:

- Enable Initial subscription fee.

- Create a subscription order.

- Observe the subscription mail of the second subscription and further subscription orders.

- The initial fee is displayed in the mail even though it is not valid.

API SPEC VERSION UPDATES

1.19 to 1.23

- Crypto payments integration in the Saferpay Payment Page

- Added Klarna Payments support for Italy and France

- New currencies for SOFORT-PLN, HUF und CZK added

- New logo updated for Bancontact and iDeal payments

- EPS Refunds supported

- Removed Bonus Card payment

1.23 to 1.24

- Implementation of refunds of crypto payments

- Soft decline handling of recurring transaction

- Management API: Added configuration in Magento backend to create Saferpay Fields access tokens via API

- Added notification URLs in Transaction/Initialize

- Support for Fraud intelligence business

- Pre-authorizations and multipart-captures for additional brands (American Express, Diners Club International / Discover Card, JCB)

- Klarna Payments: Support for extended merchant data

- SuccessNotifyUrl and FailNotifyUrl in PaymentPage/Initialize

- Supports additional payment page language (Bulgarian and Icelandic)

- Saferpay Fields improvements

1.25 to 1.28

- Integrated Google Pay payment method in Payment page and Transaction interface

- Integrated Apple Pay in Transaction interface

- Added option to save and use alias card for Google Pay payment in Transaction Interface

- Added option to save and use alias card for Apple Pay payment in Transaction Interface

- Integrated Fraud Intelligence Device Fingerprinting for more accurate fraud check

- Showed Markup and ExchangeRate values of DCC in backend order view section

- Showed Paypal customer email data in backend order view section

- Prevent API-refunds exceeding captured amount

- Management API: Added validation check to each payment while enabling saferpay payment method from Magento backend. This checks whether the

specific payment is activated in saferpay terminal or not - Management API: Retrieved logo URLs of available Payment Methods and displayed in the checkout payment section.

1.29 to 1.30

- Klarna Payments improvements payments

- iDEAL issuer preselection change- remove Handelsbanken from the list of iDEAL issuers

Recurring

- Integrated Apple Pay and Google Pay payment methods for recurring payments

- Integrated Twint and Postfinace cards for recurring payments via Direct authorization. Payment possible only if saved card data is available in customer account

- Removed Maestro and Bancontact payments from recurring payments

1.31 to 1.34

- "Auto Configure" option is added in Saferpay General Configuration to automatically configure available payments.

- Changes in Return url for Payment page, Transaction page, and Saferpay field transactions.

- Added NotifyUrl to the SecureCardData/AliasInsert request.

- Removed Fraud Intelligence changes: DeviceFingerprint was removed from all versions.

- Removed UNIONPAY as valid value from field PaymentMethods in SecureCardData/AliasInsert requests.

1.35

- Add CARD as value from field PaymentMethod in PaymentPage/Initialize requests, created as new payment method "Creditcard/Debitcard"

- Added CustomerLicense method to Saferpay Management API

- Removed CustomerLicenseConfiguration method from Saferpay Management API.

- Added container notification to Transaction/Initialize and Transaction/AuthorizeReference.

- API parameter was added for DCC emails to be sent if DCC was used.

Recurring

- enabled new payment method "Creditcard/Debitcard” for recurring payments.

1.36 to 1.38

- Worldline Crypto Payments in EUR - supports the payment method Worldline Crypto Payments in EUR for Belgium and Luxembourg.

- Removed UNIONPAY as valid value from field Payment Methods in Transaction/Initialize requests.

- Added new payment method PostFinance Pay, which will be the successor of PostFinance E-Finance & Card.

- Updated to newest version of the Prezelewy24, removed cancellation feature.

- Updated to new version of giropay.

- Added new the payment method ACCOUNTTOACCOUNT

Improvements

- Plugin version upgraded to 1.2.2

- Removed Extra level authentication configuration and replaced it with Force SCA feature configuration

- Transaction overview section will display “3Ds Authentication Type “ if 3ds data available

- Removed manual capture option from Capture type for ePrzelewy payment

- Removed Refund support for Crypto payments

- Parameter ‘HolderName’ is set to "mandatory" if configuration 'Display cardholder name on saferpay’ set to ‘Yes’ in the Magento backend payment method settings

- Saferpay module is made compatible with Magento 2.4.6-p4 version

- Saferpay recurring module is made compatible with Amasty Subscriptions & Recurring Payments Version 2.0.0.

1.39 to 1.40

- Added new payment method WeChatPay.

- Enabled PostfinancePay, for Recurring Payments.

- POSTFINANCE and POSTCARD have been removed as valid values for PaymentMethods in PaymentPage/Initialize requests.

- BANCONTACT has been removed as a valid value for PaymentMethods in Alias/Insert.

- The Styling container has been removed from PaymentPage/Initialize in all API versions.

- PaymentPage/Assert can now be called up to 120 hours for pending transactions, extending from the previous limit of 96 hours.

Improvements

- Plugin version upgraded to 1.2.3

- Saferpay module is made compatible with Magento 2.4.7 p1 version

- Saferpay recurring module is now compatible with Amasty Subscriptions & Recurring Payments Version 2.0.0.

- Added Save Card Alias Fields for CreditCard.

- Added option to capture the invoice that got interrupted due to Saferpay error..

- Compatible with Hyva theme Version1.3 and Hyva checkout Version 1.1.

1.41 to 1.43

- Added additional info about the used ISO-standard and applied restrictions to field LanguageCode of the Payer container and SecureCardData/AliasInsert requests

- Added new payment method Blik.

- Added new payment method Click to Pay.

Improvements

- Plugin version upgraded to 1.2.4

- Saferpay module is made compatible with Magento 2.4.7 p3 version

- Saferpay recurring module is now compatible with Amasty Subscriptions & Recurring Payments Version 2.0.0, 2.1.0 & 2.2.0

- GraphQL support for Magento versions from 2.4.0 to 2.4.7 p3

- Compatible with Hyva theme Version1.3 and Hyva checkout Version 1.1.